The insurance industry has recently entered a period of “market hardening” which means:

- Premiums are higher,

- Carriers are stricter with their underwriting standards, and

- Carriers are reducing the number of policies they will take on.

As a result, insurance is more expensive and harder to obtain.

Undoubtedly you’ve experienced a rise in premiums or changes to coverages at your time of renewal. Let us help try to explain what is going on…

What is fueling the rise in insurance costs?

Weather-Related Disasters

The increase in catastrophic weather events has put a huge strain on the insurance market.

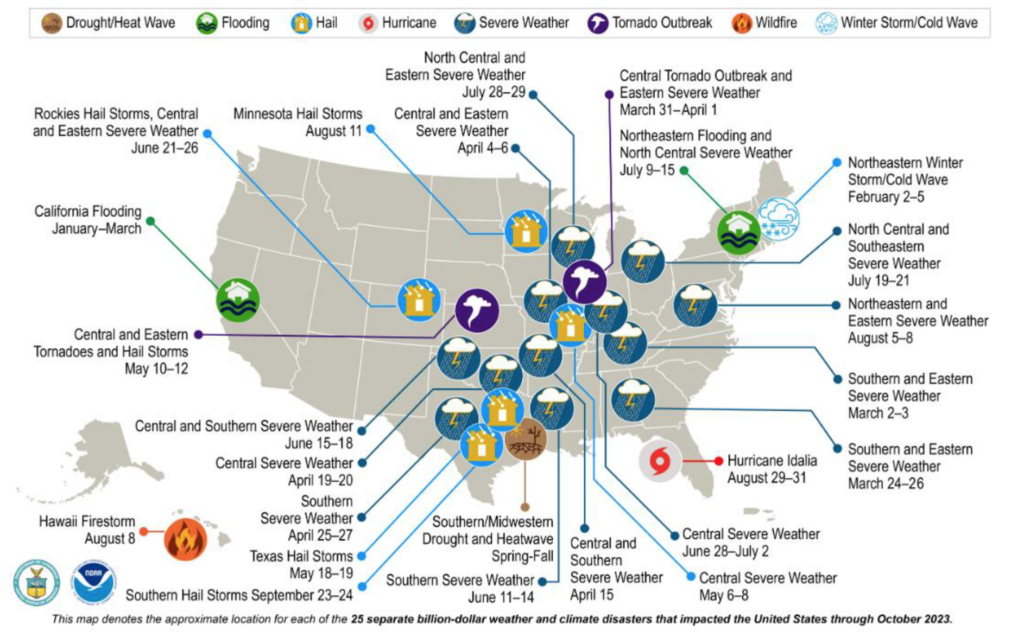

- In 2023, there were 24 weather events with industry payouts of over $1 billion each. To put this into perspective, between 1980 and 2022 the annual average number of events was 8.1. Between 2018-2022 the number was 18.1 events.

- 2023 was the most severe year for convective storm activity on record and included $92.9 billion in weather-related losses.

- Since 2008, there has not been a single year with less than $10 billion in losses from convective storms.

U.S. 2023 Billion-Dollar Weather and Climate Disasters

In order to be financially viable, insurance carriers have had to reassess their client portfolios.

For more information on insurance and weather-related events, read the Wall Street Journal article that reports on “huge losses from national disasters prompt industry to jack up prices and pull back from some markets; ‘worst possible scenario’ for consumers.”

Increased Construction & Labor Costs

Supply-chain disruption, labor shortages, and costlier replacement parts are all contributing to current and future loss pressures.

Increased cost of materials for home and auto repairs along with weather-related catastrophes and other factors have forced the insurance industry to raise rates.

Inflation

Inflation also plays a factor. Even though the media buzz around inflation has died down, many policyholders are still experiencing rate increases at the time of their renewal. This is partly because the insurance industry lags 12-18 months behind due to the lengthy process to declare, file, and implement rate changes in response to market conditions.

Additional Factors

There are a multitude of other factors that are contributing to the perfect storm of insurance vulnerability, including:

- Increased cost of reinsurance

- Regulatory changes

- “Social inflation” including a propensity for legal action and verdicts with large payouts

How are carriers responding?

Insurance companies are now dealing with client portfolios that are increasingly unprofitable and unsustainable. Market conditions have forced many carriers to take action to preserve their financial ratings.

Some things we’ve seen carriers do:

- Increase premiums

- Restrict the acceptance of new business

- Restrict product offerings

- Announce mass layoffs

- Restructure their business model due to poor underwriting results

- Exit the personal lines market altogether

These changes have resulted in many challenges for the insured.

How can Cox Insurance be your guide?

Every day we are working directly with clients to help them understand what is going on and work together to find the best solutions. With access to an array of carriers, we can advocate to get you the best coverage for the best value.

Regardless of market conditions, we will always be here for you! Please do not hesitate to set up a phone call with us to discuss your specific situation.