Our personal lines client shares his experience navigating a house fire claim.

Business Insurance: Swannies Golf

Hear directly from Swannies about how the right coverage—and the right partner—can make all the difference.

Cox Insurance Announces Four New Partners

Cox Insurance is excited to announce the addition of four new partners: Derek Gruber, Ryan Swanson, Brian Trask, and Crosby Warren. This milestone marks an exciting new chapter in the firm’s evolution and reflects the continued progress in its ownership planning— long-term strategies designed to preserve and enhance the firm’s independence.

“As a third-generation, family-led business, we are deeply committed to staying fiercely independent,” said Taylor Cox, President. “Expanding shared ownership through thoughtful succession planning ensures that we remain strong, sustainable, and client-focused for generations to come.”

The formation of this newly named group of partners, along with our entire team of associates, represents the future of Cox Insurance—one rooted in our continued dedication to clients, communities, and carrier partners.

The Cox Insurance partnership model is rooted in family values, a collaborative spirit, and a belief in the power of employee ownership. This announcement reflects another step forward in building a durable, growth-oriented, and self-managing organization.

“We believe shared ownership strengthens our culture and reinforces our commitment to the people and communities we serve,” said Hanna Cox Connor. “We’re thrilled to welcome Crosby, Brian, Ryan, and Derek as partners as we continue to build something lasting together.”

Cox Insurance Celebrates 75 Years of Excellence and Innovation in the Insurance Industry

Cox Insurance is proud to commemorate its 75th anniversary, marking a legacy of exceptional service, community engagement, and industry leadership since its founding in 1950. This milestone celebrates decades of trusted relationships with clients and a steadfast commitment to protecting what matters most.

Over the past 75 years, Cox Insurance has evolved from a small local agency to a regional leader in the insurance sector, offering a comprehensive range of personal and commercial insurance solutions. Through its innovative approach and dedication to customer satisfaction, Cox Insurance has maintained a reputation for integrity, adaptability, and forward-thinking solutions.

“As we reflect on 75 years in business, we are incredibly grateful for the trust our clients have placed in us and the dedication of our team members,” said Taylor Cox, President. “This anniversary is not just a celebration of our history but also a moment to look forward to a future filled with new opportunities and continued service to our community.”

To commemorate this remarkable milestone, Cox Insurance is hosting a series of events, including a series of lunchtime interviews with current and former employees who have been pivotal to the agency’s success. These initiatives will highlight the stories, challenges, and triumphs that have shaped the agency over the years.

The agency remains deeply committed to its founding principles of personalized service and community involvement. In celebration of its 75th anniversary, Cox Insurance is reaffirming its dedication to supporting the community and strengthening connections with those it serves.

New law shortens defensive driving classes

A law going into effect July 1 shortens classes for first-time participants from eight hours to four, matching the same length of refresher courses that drivers seeking to keep their state-mandated 10% discount on their auto insurance premiums must take every three years.

For more information, check out this article “New law shortens defensive driving classes for seniors taking it for the first time” from the StarTribune.

Navigating the 2024 Insurance Market

The insurance industry has recently entered a period of “market hardening” which means:

- Premiums are higher,

- Carriers are stricter with their underwriting standards, and

- Carriers are reducing the number of policies they will take on.

As a result, insurance is more expensive and harder to obtain.

Undoubtedly you’ve experienced a rise in premiums or changes to coverages at your time of renewal. Let us help try to explain what is going on…

What is fueling the rise in insurance costs?

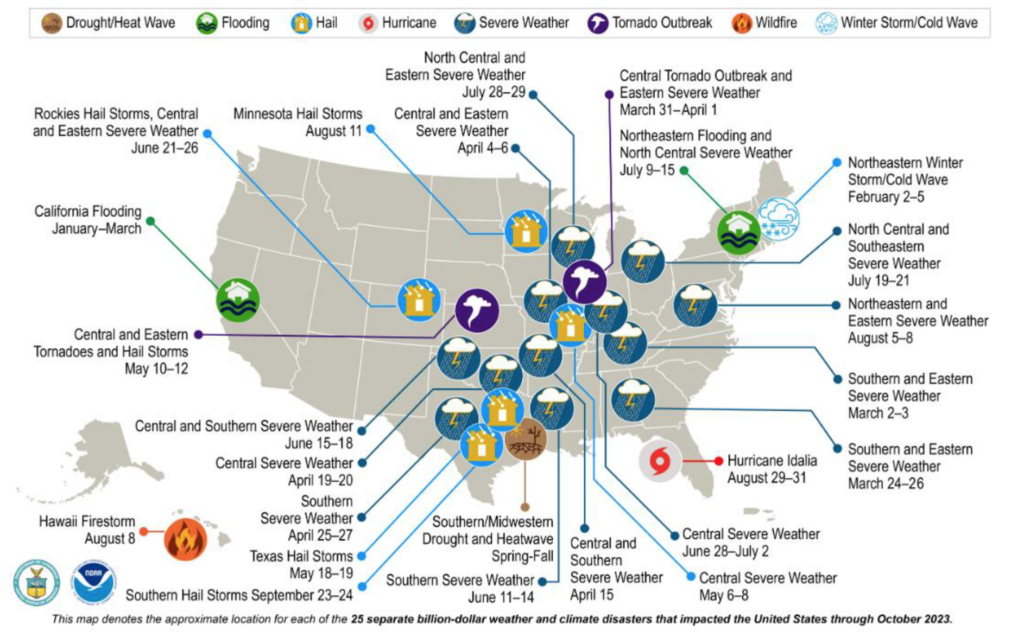

Weather-Related Disasters

The increase in catastrophic weather events has put a huge strain on the insurance market.

- In 2023, there were 24 weather events with industry payouts of over $1 billion each. To put this into perspective, between 1980 and 2022 the annual average number of events was 8.1. Between 2018-2022 the number was 18.1 events.

- 2023 was the most severe year for convective storm activity on record and included $92.9 billion in weather-related losses.

- Since 2008, there has not been a single year with less than $10 billion in losses from convective storms.

U.S. 2023 Billion-Dollar Weather and Climate Disasters

In order to be financially viable, insurance carriers have had to reassess their client portfolios.

For more information on insurance and weather-related events, read the Wall Street Journal article that reports on “huge losses from national disasters prompt industry to jack up prices and pull back from some markets; ‘worst possible scenario’ for consumers.”

Increased Construction & Labor Costs

Supply-chain disruption, labor shortages, and costlier replacement parts are all contributing to current and future loss pressures.

Increased cost of materials for home and auto repairs along with weather-related catastrophes and other factors have forced the insurance industry to raise rates.

Inflation

Inflation also plays a factor. Even though the media buzz around inflation has died down, many policyholders are still experiencing rate increases at the time of their renewal. This is partly because the insurance industry lags 12-18 months behind due to the lengthy process to declare, file, and implement rate changes in response to market conditions.

Additional Factors

There are a multitude of other factors that are contributing to the perfect storm of insurance vulnerability, including:

- Increased cost of reinsurance

- Regulatory changes

- “Social inflation” including a propensity for legal action and verdicts with large payouts

How are carriers responding?

Insurance companies are now dealing with client portfolios that are increasingly unprofitable and unsustainable. Market conditions have forced many carriers to take action to preserve their financial ratings.

Some things we’ve seen carriers do:

- Increase premiums

- Restrict the acceptance of new business

- Restrict product offerings

- Announce mass layoffs

- Restructure their business model due to poor underwriting results

- Exit the personal lines market altogether

These changes have resulted in many challenges for the insured.

How can Cox Insurance be your guide?

Every day we are working directly with clients to help them understand what is going on and work together to find the best solutions. With access to an array of carriers, we can advocate to get you the best coverage for the best value.

Regardless of market conditions, we will always be here for you! Please do not hesitate to set up a phone call with us to discuss your specific situation.